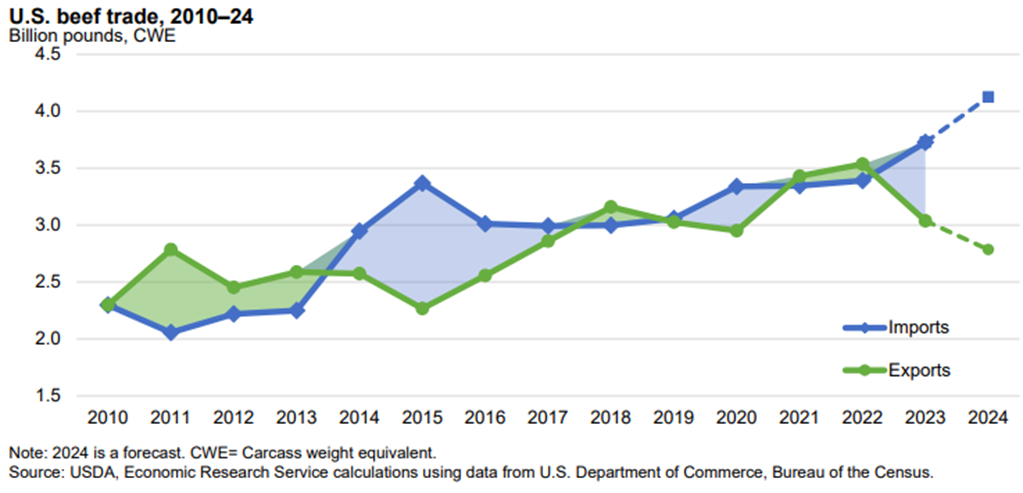

USDA trade data for December 2023 was recently released, closing out a contractionary year of the cattle cycle where, as expected, exports fell and imports rose. This created a trade deficit by volume (imports larger than exports) for the first time since 2020.

The chart above shows the reversal of the trade balance from the last 2 years. Given much smaller production and continued strong domestic demand for beef, the trade deficit is expected to widen in 2024.

The trade deficit in 2023 shown in the chart above is based on volumes. The United States is well known as both a major global exporter and importer of beef due to exporting high-quality product and importing large amounts of lower value processing-grade trimmings for blending into hamburgers. This is evidenced—despite the differences in volume—by the annual value of U.S. beef exports in 2023 of over $9.3 billion, while the value of imports was just under $9 billion. Therefore, from a value perspective, there was a trade surplus of more than $350 million.

Looking back at 2023, the total volume of exports was 3.038 billion pounds, a year-over-year decrease of 14 percent. South Korea was the top market for U.S. beef exports with a share of 22 percent, though shipments to the country fell 17 percent year over year. Exports to Japan, the leading market for U.S. beef for the last decade, decreased 22 percent year over year, resulting in a 21-percent share of total U.S. exports for the year. Exports to China fell 20 percent year over year. Of the top six markets, only exports to Mexico showed a year-over-year increase, up 12 percent, and exports to Canada only declined 2 percent for the year. As a result, the share of exports to our North American neighbors combined increased 3 percentage points over 2022, while the share of exports to the top Asian markets combined fell 3 percent.

On the import side, total imports reached a record 3.727 billion pounds, a year-over-year increase of nearly 10 percent. Driving this increase were imports from Australia and New Zealand, up 66 and 33 percent, respectively. Canada was again the top supplier of beef to the United States, accounting for 27 percent of imports. Australia jumped back up to the number two spot this year, increasing to a share of 18 percent of U.S. imports. Imports from Mexico, the third largest supplier in 2023, showed a 12-percent decrease, with the share of total imports falling to 17 percent. New Zealand and Brazil rounded out the top five suppliers, with shares of 14 and 12 percent, respectively.