Derrell S. Peel, Oklahoma State University

Cattle and beef markets rocketed out of the gate coming into 2025. With no post-holiday wavering, all cattle and beef markets moved higher in the first half of January – setting new record price levels to start the new year. This continues the trend of the last three years. Cattle prices began to move higher after 2021 and increased more sharply in 2023-2024.

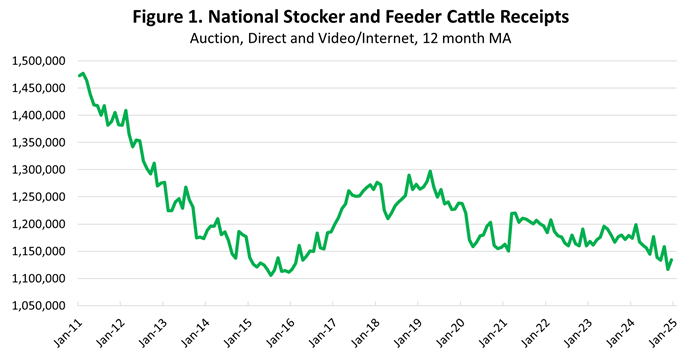

In Oklahoma auctions in the week ending January 17, 2025, the price of 500-pound steers (M/L, #1) was $361.88/cwt., up 18.1 percent year over year and up 111.1 percent from the same week four years ago in 2021. For 800-pound steers, the price was $269.07/cwt., up 21.0 percent year over year and up 105.1 percent in the last four years. The U.S. calf crop peaked cyclically in 2018 at 36.3 million head and decreased for the last six years to a projected 33.1 million head in 2024. Figure 1 above shows the average volume of stocker and feeder receipts including the general downtrend since the recent peak in early 2019 and indicates a continued tightening of cattle numbers.

The 5-market fed steer live price was $203.56/cwt. for the week ending January 17, up 17.3 percent from one year ago and up 85.9 percent from January 2021. Daily 5-market fed steer prices hit $200/cwt. for the first time ever on January 7 and reached as high as $205.37/cwt. on January 15. Higher fed prices are expected ahead.

The Oklahoma price of average dressing Boning cull cows was $124.31/cwt. last week, up 21.1 percent from one year ago and up 149.5 percent from the same week in 2021. Cull cow prices last week ranged from $136.82/cwt. for high dressing Breaker cows to $110.09/cwt. for low dressing Lean cows.

The weekly Choice boxed beef price for mid-January was $333.51/cwt., up 17.7 percent year over year and up 58.2 percent over 2021 levels. The rib primal price last week was $508.06/cwt., up 2.4 percent year over year and up 50.2 percent from the same week in 2021. The latest loin primal price was $393.99/cwt., up 4.9 percent over last year and up 49.7 percent from 2021. The end meats are stronger relative to the middle meats, with the chuck primal price last week at $303.91/cwt., up 33.2 percent year over year and up 60.5 percent since 2021. The round primal price currently is $302.66/cwt., up 36.1 percent from one year ago and up 65.9 percent from 2021.

The strong cattle and beef price trend coming into 2025 is expected to continue as cattle inventories and beef supplies tighten further in the coming months. However, while cattle and beef markets are very strong internally, external shocks from political uncertainty along with U.S. and global macroeconomic jitters may cause short-term shocks and short-lived market setbacks. Volatility is likely to accompany a bullish market expectation.